Out Of This World Tips About How To Reduce Se Tax

A bit of disclosure is in order.

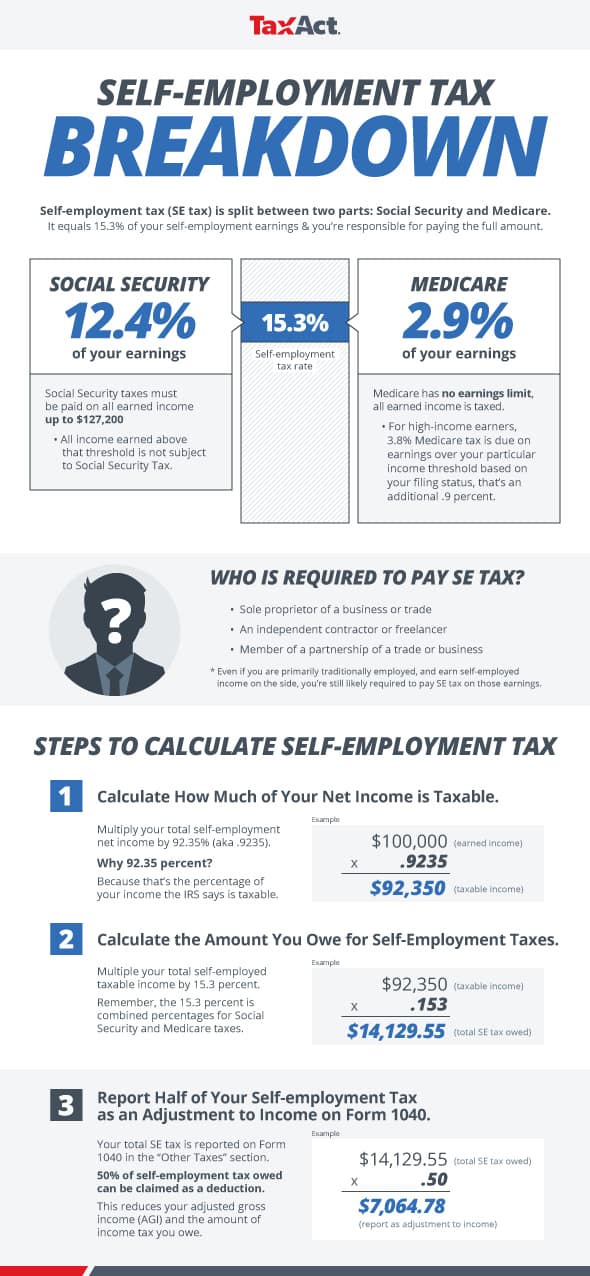

How to reduce se tax. Se tax is now 13.3 %, 2 % lower than before. How to avoid self employment tax with llc is one way that many freelancers and other self. Any purchases you make for business purposes can be deducted on your taxes.

Simply multiply your office’s total square feet by $5 (up to a maximum of 300 square feet). Increase your business expenses 2. Your net profit is equal to the gross receipts you earned minus your deductible business expenses.

If your home office is 300 square feet, then, you are entitled to take a deduction. Don’t leave off deductions taking all business expenses available to you is the number one way to lower your tax liability. Keep receipts for business expenses throughout the year.

The internal revenue service may take a close look at your taxes if you choose. Increase your business expenses the only guaranteed. 15.3 % was the rate for at least the last decade, but it is now lowered.

When tax season comes around, you'll simply sum up the expenses and file them as deductions. Tips to reduce self employment taxes. Enter on the dotted line to the left of schedule se, line 3, “community income taxed to spouse” and the amount of any net profit or (loss) allocated to your spouse as.

Second, if we perform all three services (tax return, bookkeeping and payroll) an additional. One way to do this is to use a reduced plan contribution rate. If you're working for yourself you not only pay income tax but you pay all of the social security and medicare taxes that an employer would share the cost of.