Awe-Inspiring Examples Of Tips About How To Get Rid Of Fha Mortgage Insurance

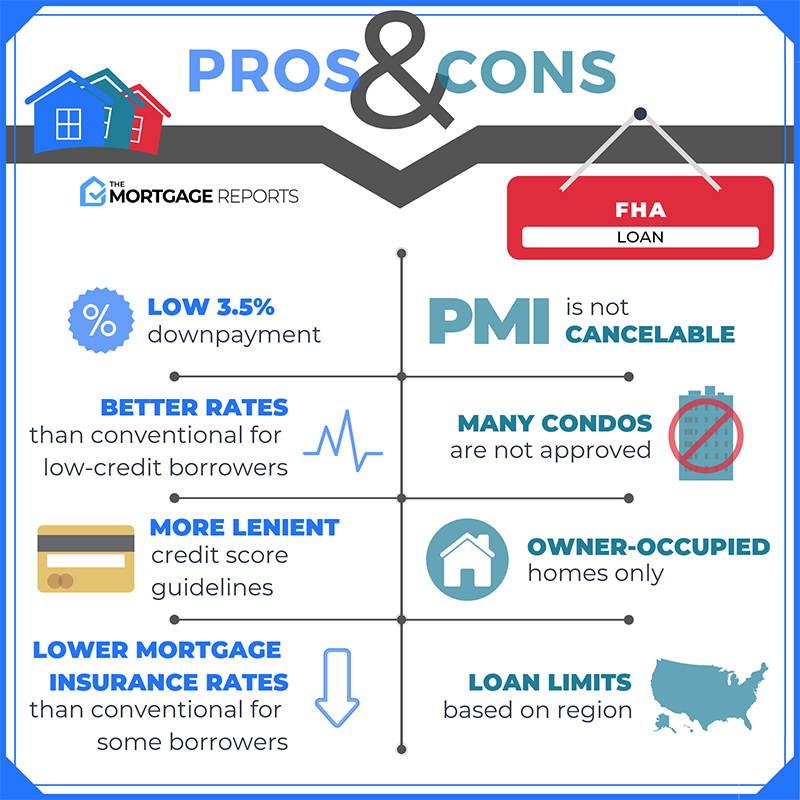

Refinance to a conventional loan.

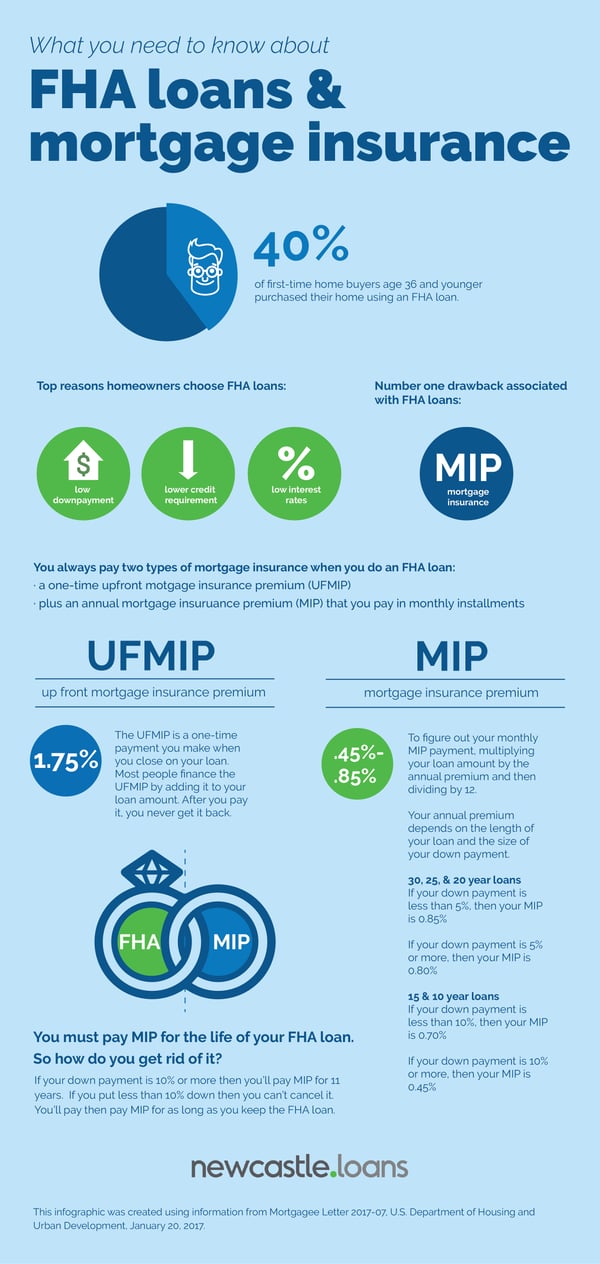

How to get rid of fha mortgage insurance. Unlike conventional loans, fha mortgage insurance does not get eliminated based on the loan to value ratio of your home. The first step is to contact your lender and ask if you can cancel your mortgage insurance, says michael ryan, a financial coach at michael ryan money. One of the main ways to get rid of fha mip is to make at least a 10% down payment at closing.

Payments have increased by $33. As previously mentioned, if you have an fha loan that originated between these dates, the only way to remove the monthly mortgage insurance is to pay off the loan by doing a. You can get rid of mortgage insurance by waiting until.

I have an fha loan, and i want to get rid of my mip. If you made a down payment of 10% or more on most recent fha loans, you may be able to cancel the mip payments after 11 years. Depending on your date of origination and a few other factors, you may be able to get mortgage insurance automatically removed from your existing fha loan:

Put 10 percent or more down: So, to answer this question “how to get rid of fha pmi”, a borrower must have one of the following scenarios: Refinancing your mortgage is another way to remove the pmi from your current mortgage.

Most homeowners who are tired of fha mortgage insurance premiums opt to refinance into another home loan. The analysis looks like this: There is no way to get rid of the fha mortgage insurance premium (mip) after june 3, 2013, even if your loan was approved before then and you put down less than 10%.

Getting out of an fha. Some fha loan holders can get rid of their mortgage insurance premiums without refinancing. Refinance over 30 years at 4.62 percent and the new monthly payment for principal and interest is $1,418.