Recommendation Info About How To Lower Credit Card Balance

_1.jpg?ext=.jpg)

Then, mentally set that money aside for the upcoming.

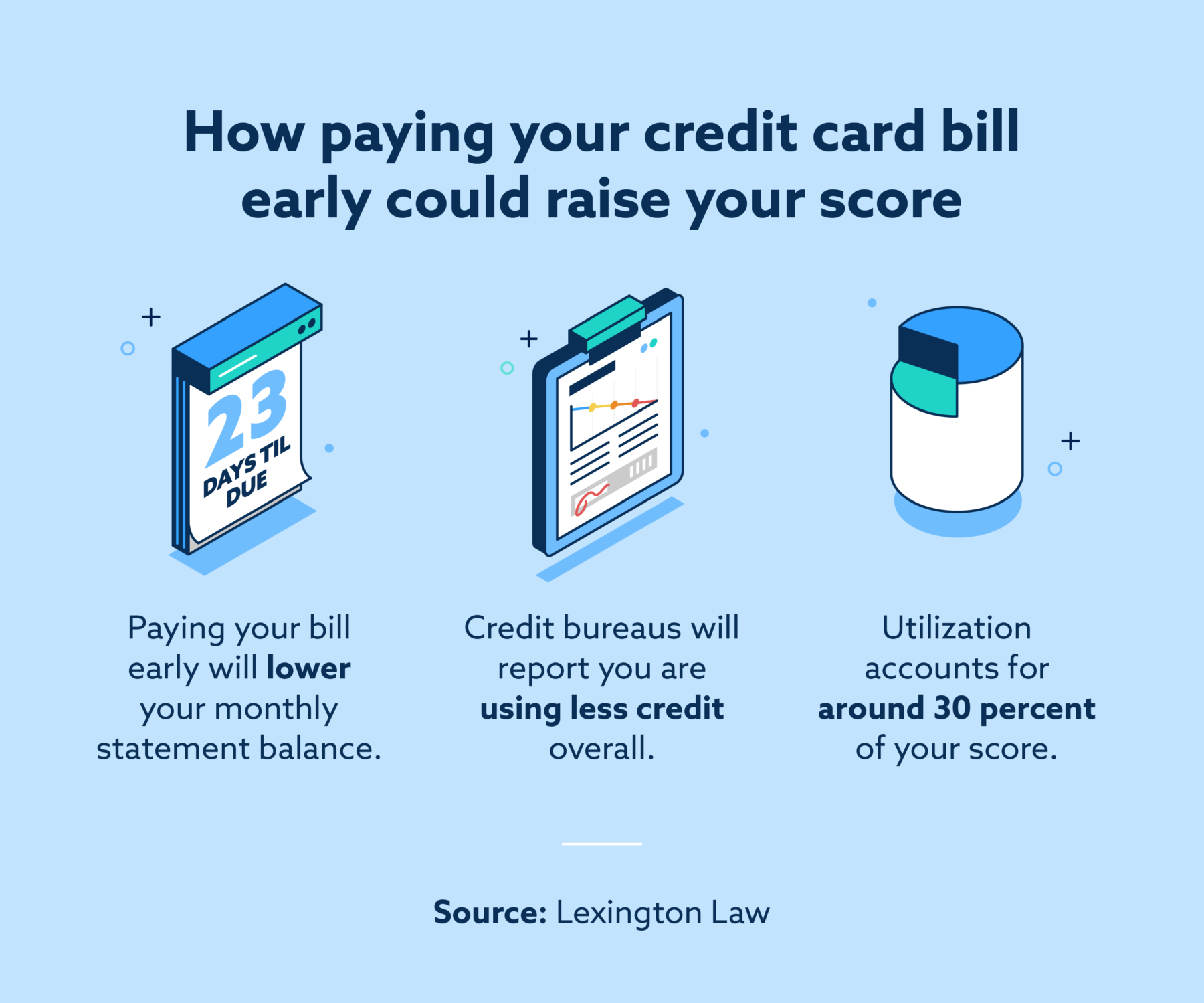

How to lower credit card balance. $5,000 (total credit card balances) ÷ $20,000 (total credit. In the first box, enter the amount of debt on your current card that you’re looking to transfer. 4.9/5 ( 34 votes ) the reality is that carrying a balance could actually hurt your credit scores.

Finally, multiply this number by 100 to find your credit utilization ratio as a percentage amount. “one way to lower your monthly credit card bill is to open a new card with a 0% apr for an introductory period, and transfer your existing credit card balances to it,” said davis. Only use your credit card for a purchase that you can already afford to pay for in full.

If you have good to excellent credit,. If you can’t get your credit card issuer to lower your rate, then it may be time to move on to another lender. Balance transfer as an alternative to a lower rate, for credit cardholders facing carried balances with high interest rates, a balance transfer card option may help reduce a rate.

Treat your credit card like a debit card. Or, if you do not qualify for. First, by closing the credit card you will no longer be able to use the card to make purchases.

Enter your current card’s details in the balance transfer calculator boxes. Interest free payments until 2024. Many credit cards offer a 0% introductory interest rate for a limited time.

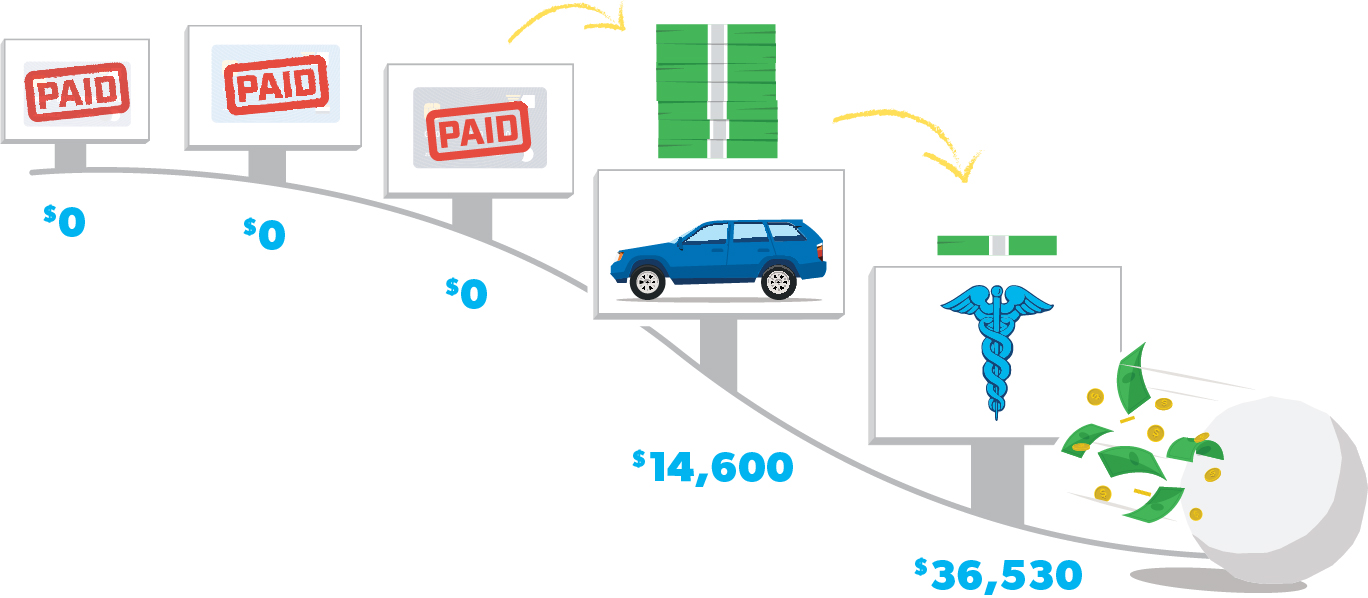

Consider a balance transfer card. If your credit card balances are out of control, you'll want to come up with a way to pay them down. Thanks to your new credit card account and balance transfer, your overall credit utilization rate would drop to 25%.