Fantastic Tips About How To Find Out Your Credit Score Canada

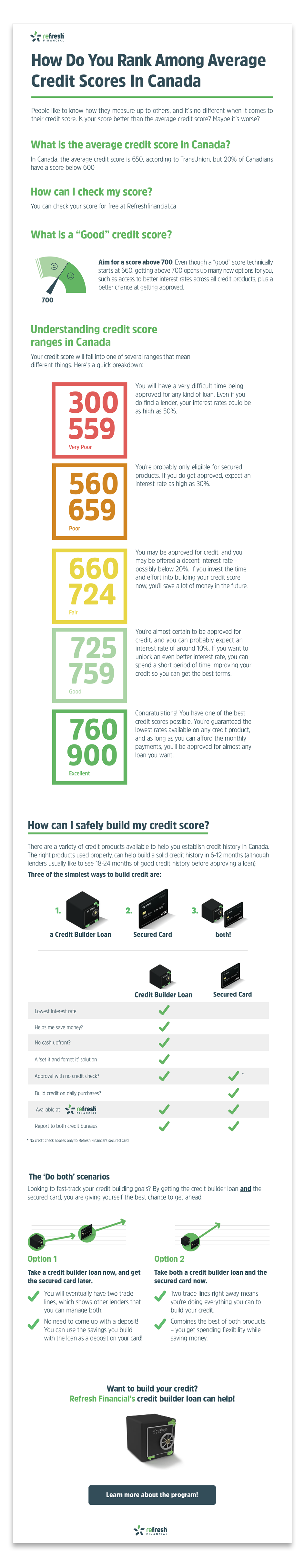

Both equifax and transunion provide credit scores for a fee.

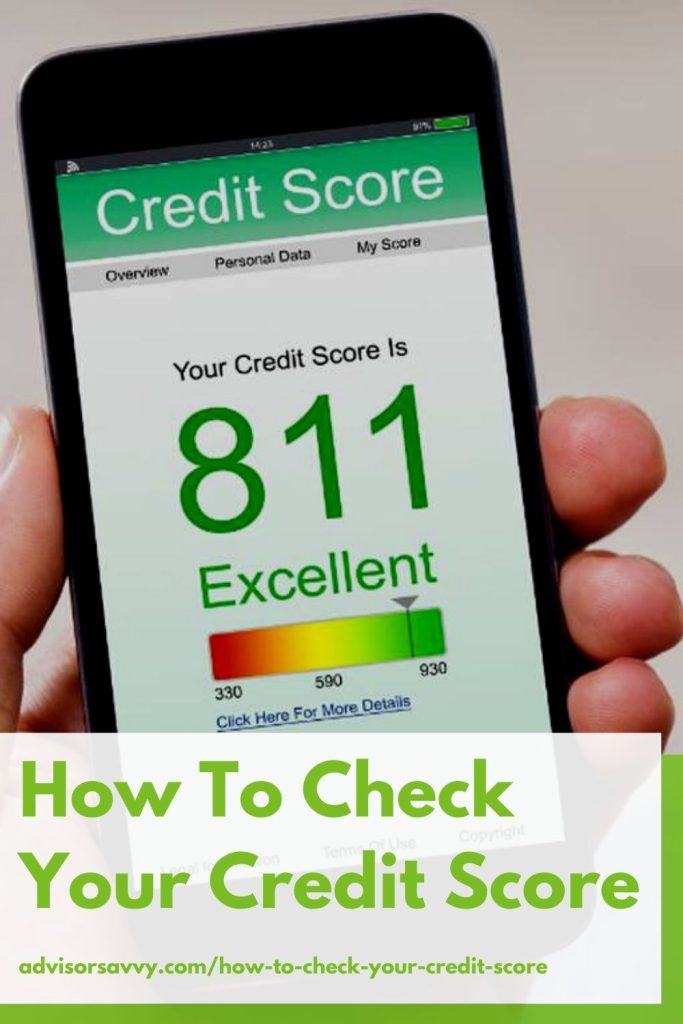

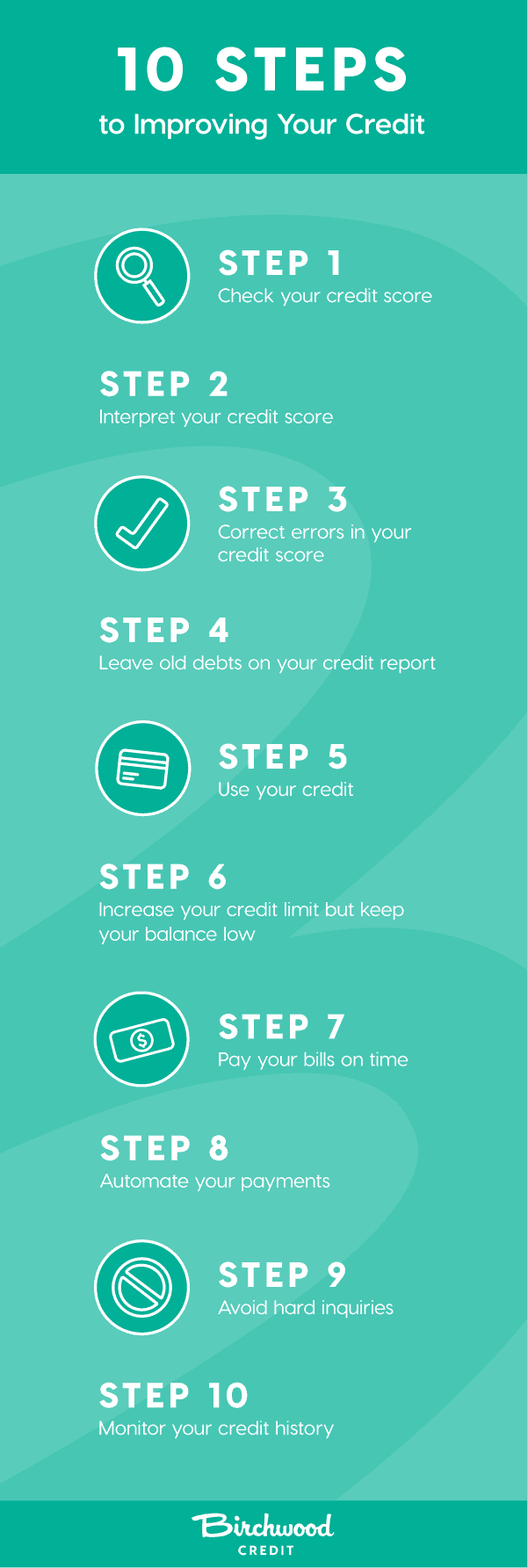

How to find out your credit score canada. It may be on your statement, or you can access it online by logging into your account. Contact your provincial or territorial consumer affairs office for information on laws related to credit reporting. There are several good ways to check your credit score in canada.

You can access your credit score online from canada’s 2 main credit bureaus. Here are a few ways: As credit bureaus are in charge of calculating your credit score, they are an obvious place to start.

For residents of quebec, it’s free to check your score directly with one of the two credit bureaus (transunion. Visit the transunion credit report portal and sign up for an account with them. The sbfe is where most banks report loan data, so the.

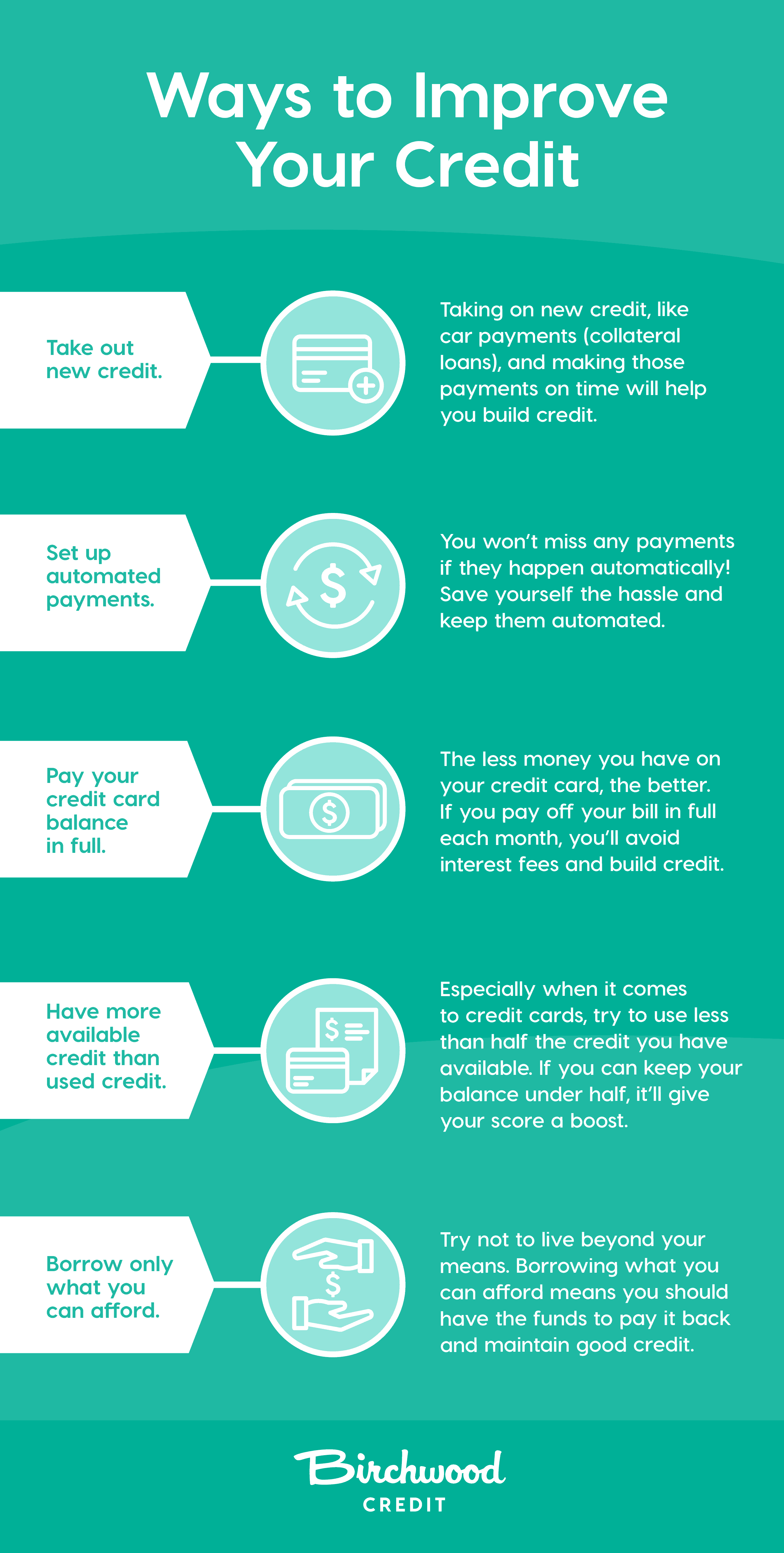

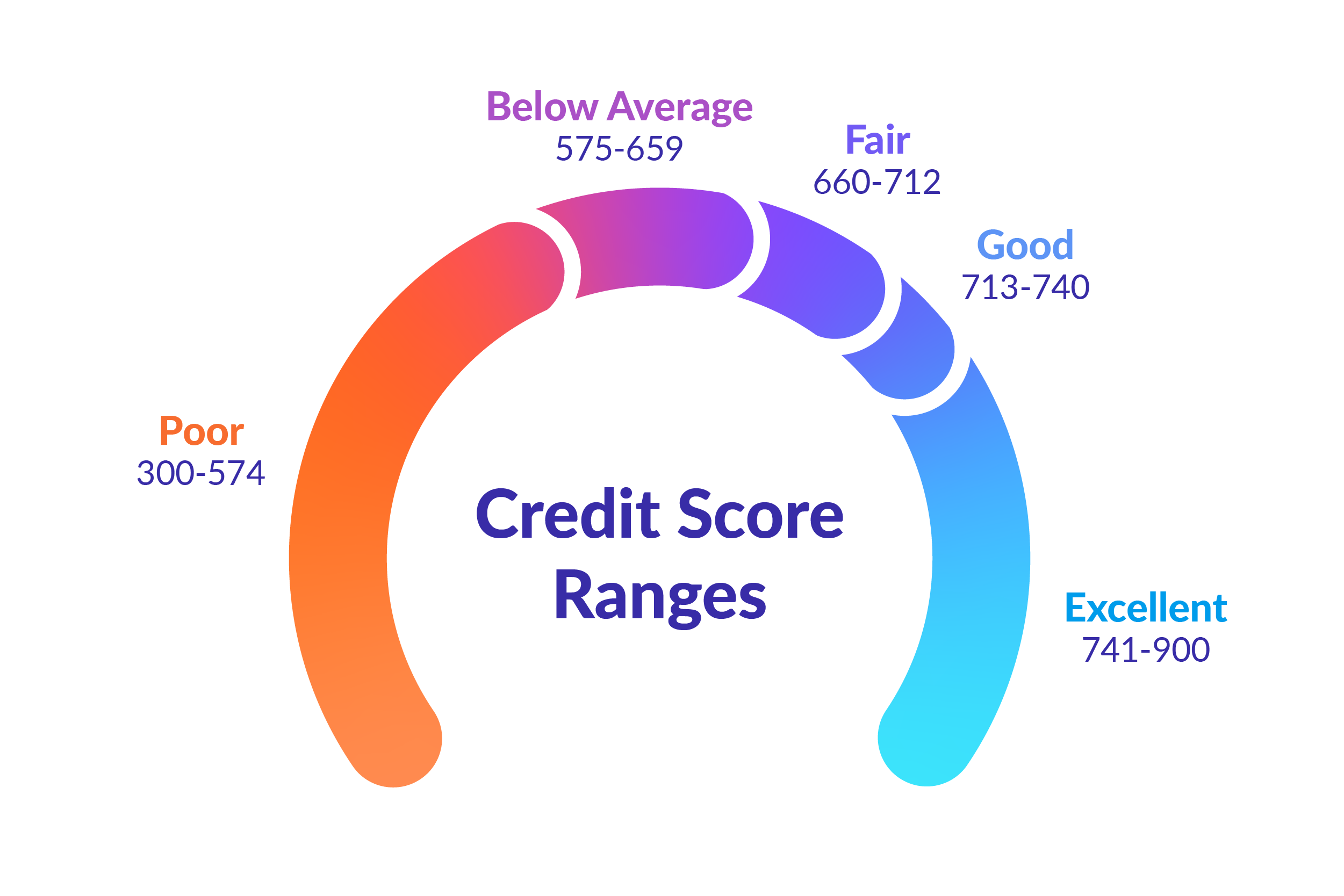

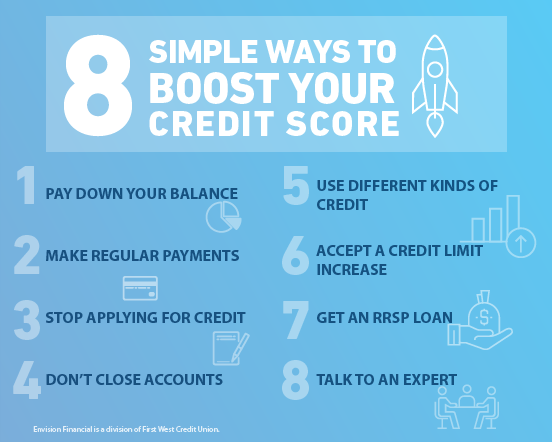

Credit scores are commonly based on information in your credit report, including your payment history, amounts owed, credit history length, credit mix and new credit. Monitor your credit score [free]: Viewing your score is free and has no impact on your score over time.

Getting your free credit score check is simple when you're a scotiabank customer. To access your transunion credit score, scotiabank will share your personal information such as name, address and date of birth with transunion so that transunion can identify you and. To view your score in online banking:

Purchase credit scores directly from one of the three major credit bureaus or other provider, such as. Purchase credit scores from a canadian credit bureau. What's included in your credit report your credit report contains personal,.

![Do I Have A Bad Credit Score? [And How Does It Affect My Life?] | Legacy Auto Credit](https://d1lliwtrv5z90u.cloudfront.net/wp-content/uploads/2020/04/13160815/credit-score.png)