Unbelievable Tips About How To Apply For State Tax Id

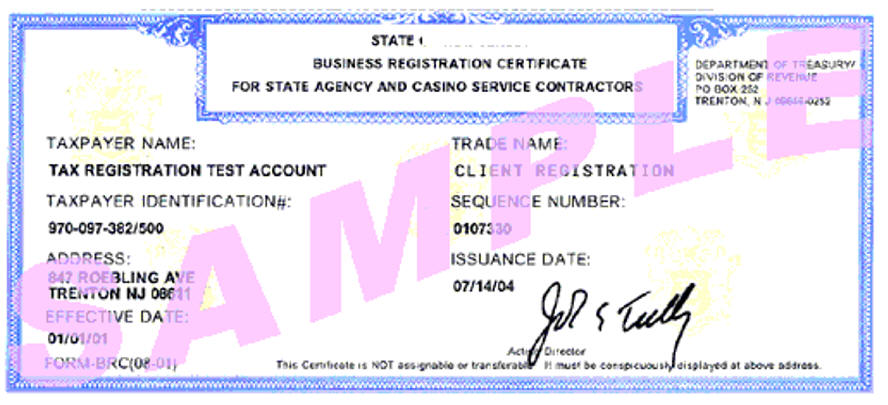

Your brc will include a control number used only to verify that.

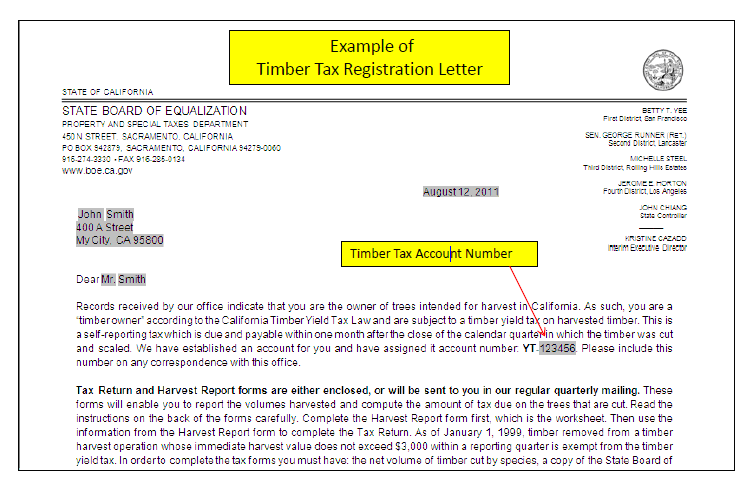

How to apply for state tax id. If you are filing taxes after the event and do not have a license, you. How to get a state tax id number for a small business step 1. If your spouse/partner/dependent child is also a state of iowa employee:

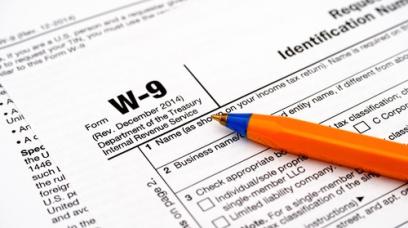

As implied in the section above, you can also apply for your tax id over the phone; Register for a utah sales tax license online by filling out and submitting the “state sales tax registration” form. The person applying online must have a valid.

Sections 526.10 and 533.1 publications: Provide the requested information in the state application. Register your business with the secretary of state's office for your state.

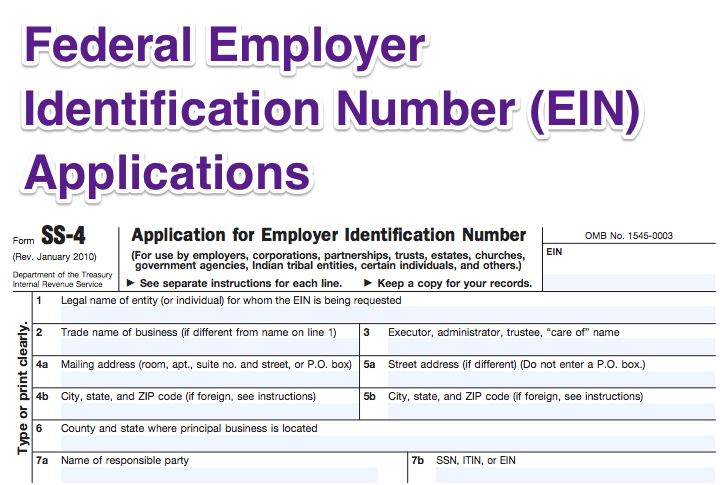

In this method, you’ll answer many of the same questions,. Any entity that conducts business within georgia may be required to register for one or more tax specific identification numbers, permits, and/or licenses. The benefits of an ein number.

Apply for massachusetts tax id by phone, mail or fax. Publication 20, new york state. This license will furnish your business with a unique sales tax number (utah.

The use of this number on all billings will reduce the time required to process billings to the state of texas. If you’re prepared, you can probably complete the application in just a few minutes, but be. File income tax returns for the estate on form 1041.